Here Are 2 of the Best Robotics Stocks to Buy Now

/global%20technology%20internet%20globalization.jpg)

The global trend towards automation is driving demand for robotics across a wide range of industries. Companies are becoming more dependent on robotic solutions to improve productivity and minimize costs.

Robotics, artificial intelligence (AI), and machine learning are constantly evolving. Furthermore, robotics has numerous applications, providing investors with exposure to a diverse range of industries.

That said, the competitive landscape in the robotics sector can be intense, and not all companies will succeed. Here are two robotic stocks that might pique investors' interest in the sector now.

UiPath Stock

My first choice is the global software company UiPath (PATH). Founded in 2005, UiPath is a leader in robotic process automation (RPA). The company's platform provides a comprehensive suite of tools for designing, deploying, and managing software robots, commonly known as "bots."

UiPath skyrocketed last year, gaining 95% to outpace the S&P 500 Index’s ($SPX) gain of 25% - largely driven by its outstanding third-quarter fiscal 2024 results.

UiPath enables organizations to automate routine and time-consuming duties, therefore minimizing manual errors and enhancing overall productivity. This explains why its products are in high demand, with annual recurring revenue (ARR) increasing by 24% year-on-year to $1.4 billion in the most recent quarter.

Total revenue of $326 million came in 24% higher than the year-ago quarter. The company is not profitable yet, but its operating loss narrowed to $55.8 million, compared to $67 million in the prior-year quarter. Analysts predict UiPath will report a profit of $0.47 for the full fiscal year 2024.

UiPath's versatility makes it an invaluable resource for any organization looking to automate repetitive tasks. The company has now unveiled UiPath Autopilot, which uses generative and specialized AI to improve productivity.

While UiPath invests heavily in AI projects, it also maintains a strong balance sheet. The company ended the fiscal third quarter with $1.8 billion in cash, cash equivalents, and marketable securities, as well as an adjusted free cash flow of $44 million.

UiPath is expected to report fourth-quarter fiscal 2024 earnings next month. Management anticipates a 23% to 25% year-over-year increase in revenue, with an ARR of around $1.45 billion.

While many people fear that RPA will take over jobs, it automates repetitive and rule-based tasks, allowing people to focus on the creative aspects of their roles.

Gartner's market study found that UiPath currently holds a 36% share of the global RPA market. The global RPA market, which was worth $2.9 billion in 2023, is expected to expand at a compound annual growth rate of 39.9% by 2030. This means that UiPath has plenty of room to grow in this space as the AI era progresses.

Revenue is projected to increase by 18.8% in fiscal 2025. Trading at 8 times forward sales, UiPath is a bargain for an AI robotics stock with stellar prospects ahead.

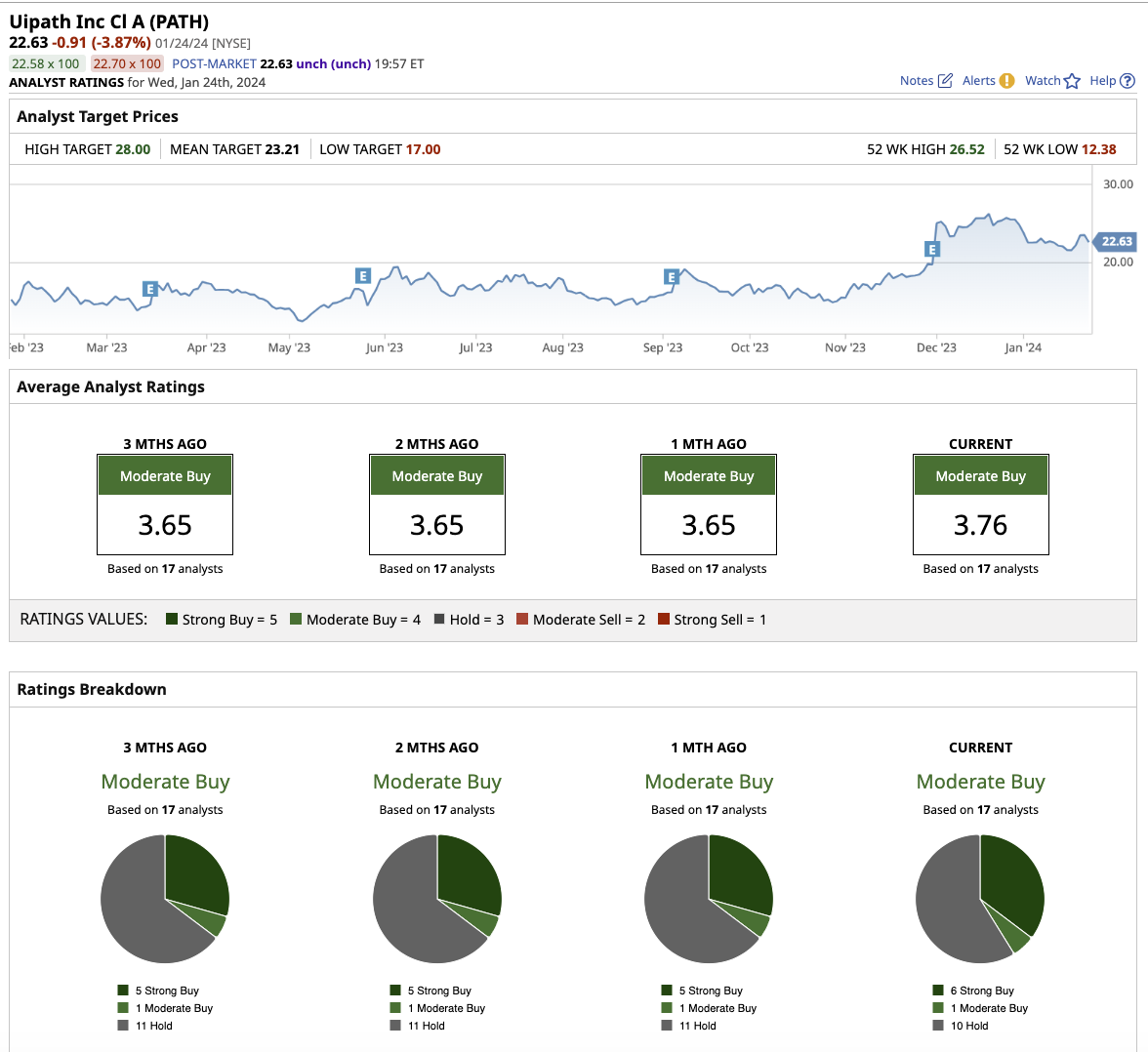

Overall, Wall Street rates UiPath stock a “moderate buy.” Out of the 17 analysts covering the stock, six rate it a “strong buy,” one rates it a “moderate buy,” and 10 rate it a “hold.” UiPath stock is trading nearly flat with its average target price of $23.21. However, its high target price of $28 indicates a potential upside of 20.4% over the next 12 months.

Roblox Stock

Roblox (RBLX), which debuted in 2006, has evolved into a virtual universe where players can create, share, and play games designed by both the platform's developers and its user community.

Its popularity stems from a focus on user-created content. The platform's intuitive game development tools allow players to create their own games, ranging from simple challenges to intricate virtual environments. This has resulted in a sizable and diverse library of games intended for a wide range of users.

Roblox is accessible on a wide array of platforms, including Windows, PC, Mac, iOS, Android, and Xbox One. This cross-platform accessibility has also contributed to Roblox's widespread popularity.

RBLX rose 60% last year, outperforming the broader market's 25% gain.

The company’s resilience is evidenced by its outstanding revenue growth from $325 million in 2018 to $2.2 billion in 2022. For the nine months ended September 2023, Roblox generated $713 million in revenue, putting it on track to meet the consensus 2023 revenue target of $3.44 billion. This would represent a 19.8% increase over 2022 levels.

Revenue grew double-digits in all three quarters of 2023, including a whopping 38% increase in the most recent quarter. Bookings were up 20% year-over-year in Q3. Average daily active users jumped to 70.2 million from 47.3 million in Q3 2021.

While the company’s revenue is growing at a rapid pace, controlling costs is necessary for Roblox to turn its bottom line green.

Roblox ended the quarter with a robust balance sheet, including $2.1 billion in cash, cash equivalents, investments, net of long-term debts, and $59.5 million in free cash flow. The company is in a comfortable financial position to continue investing in AI, brands, and advertising to drive profits.

Looking ahead, Roblox will report its fourth-quarter earnings on Feb. 7. While the company does not provide forward guidance, analysts predict revenue of $1.08 billion for the quarter.

Trading at six times forward 2024 sales, Roblox appears to be a cheap robotics stock to buy now. Analysts predict revenue to increase by 16.6% in 2024.

Wall Street has assigned a “moderate buy” rating to Roblox stock overall. Out of 23 analysts covering the stock, 14 rate it a “strong buy,” one recommends a “moderate buy,” four rate it a "hold,” and four rate it a “strong sell.” The mean target price for Roblox stock is $43.86, which is 6.5% above current levels.

Why Invest in Robotics Stocks?

The global pandemic brought to light the significance of robust and adaptable supply chains. Here, robotics plays a crucial role. As industries continue to embrace automation, robotics companies have significant long-term growth potential. The increasing demand for smart manufacturing, autonomous vehicles, and other robotic applications creates opportunities for sustained growth.

Both UiPath (PATH) and Roblox (RBLX) have proven the strength of their business models. Growing interest in innovative technologies, including robotics and AI, can contribute to positive momentum in UiPath's and Roblox's stock prices going forward. Given their currently reasonable valuations, both stocks appear to be good long-term investments right now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.